US Pay Stubs Sample Explanation:

The NET PAY on pay stubs (also known as pay slip or salary slip) for the same GROSS PAY for an employee working with the same employer will be different based on cities, counties, states and exemptions/deductions where the employee works because in some states there is no state tax/high state tax/less state tax. Employees working with two different employers NET PAY will be also different for the same GROSS PAY in same state/county/city /exemptions because of the benefits offered by the employer.

We have given samples of pay stub of California and New York. Even though the employee’s GROSS pay is more, NET PAY is less because of taxes, and benefits.

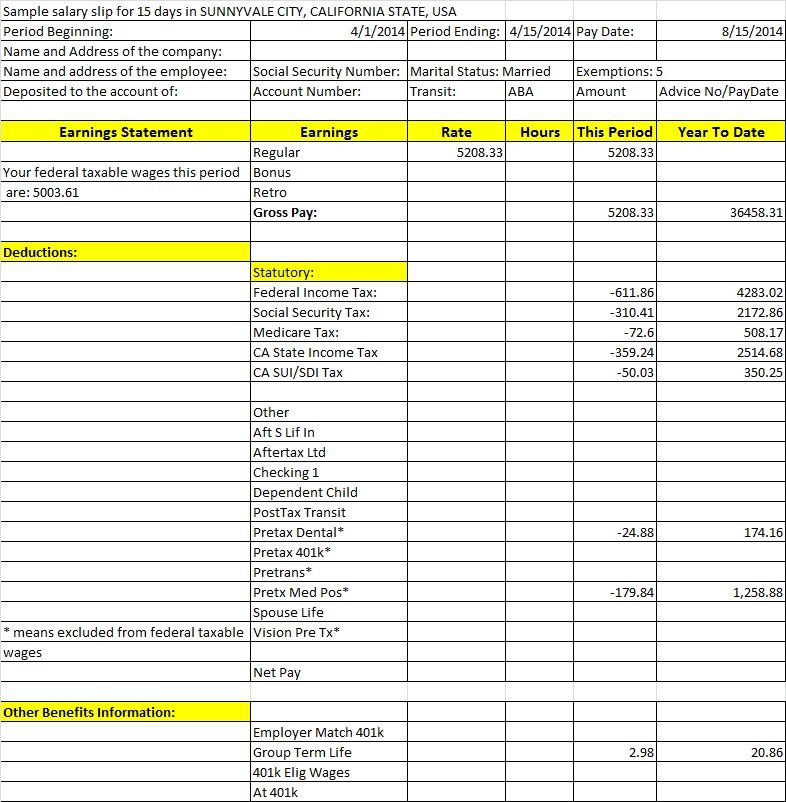

California Pay Stub Sample:

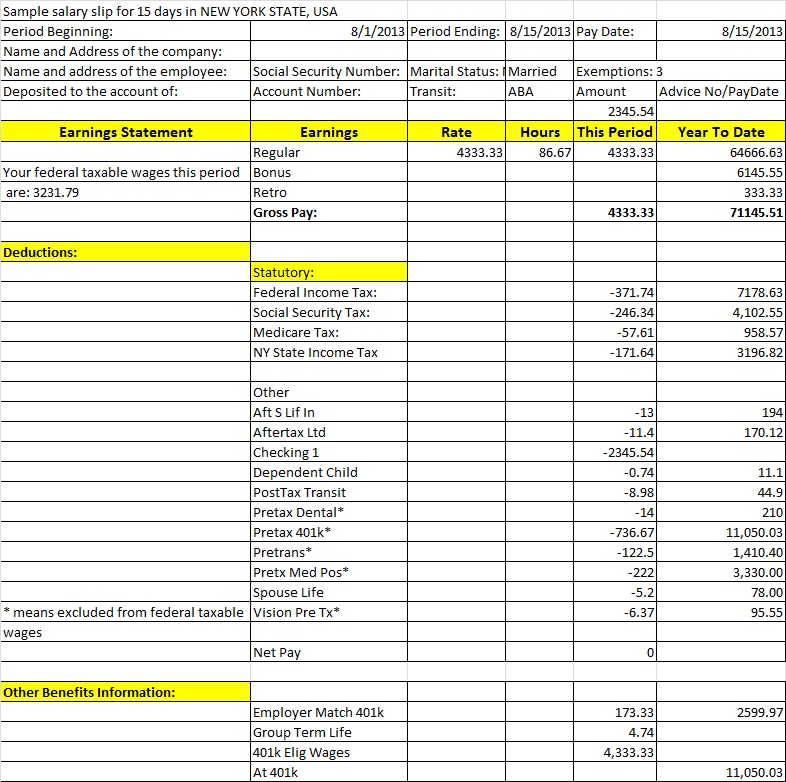

New York Pay Stub Sample:

Information present in Pay Stub:

- Employer/Employer Information, Pay Date, Pay Period etc.

- Amount paid for that period and Year to Date (starting from 1st Jan until that Pay stub Date).

- Gross salary and net salary.

- Pay stub shows the mandatory taxes like Federal Income Tax, Social Security Tax, and Medicare Tax paid to Government Agencies.

- Amount paid to Benefits like 401k, Group Term Life Insurance, Health Insurance, Vision Insurance.

- Amount paid to State Government, Counties and Cities.

- Show no of exemptions/deductions. This will allow the employer to deduct right tax amount.

To know more about this topic, please reach us at AntonysTrainingandSolution@Gmail.com

Latest posts by LearnHire (see all)

- Sample Recruitment Video - September 4, 2021

- US IT Recruiter/Bench Sales Videos For Sale From LearnHiring.com - May 30, 2021

- Recruiter Video Course for Subscription - December 22, 2020